30+ What can i borrow on my salary

How much mortgage can you borrow on your salary. With such a hefty down payment how many times your salary can you borrow for a mortgage.

Money Challenge How To Save 500 In 30 Days Money Saving Tips Saving Money Money Challenge

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability.

. You need to make 138431 a year to afford a 450k mortgage. If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000. Youre overextended by trying to pay a huge mortgage saving too much for.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Saving a bigger deposit. For this reason our calculator uses your.

Provide a 15 deposit 30k youll need to borrow 160000 which is. This mortgage calculator will show how much you can afford. You can use the above calculator to estimate how.

Fill in the entry fields and click on the View Report button to see a. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. When it comes to calculating affordability your income debts and down payment are primary factors.

Glassdoor reports that the average blogger salary is over 50000 per year based on several anonymously submitted salaries. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Your wife WILL go togo.

Mortgage lenders in the UK. Generally lend between 3 to 45 times an individuals annual income. For instance if your annual income is 50000 that means a lender may grant you around.

Whether youre paying cash leasing or financing a car your upper spending limit really shouldnt be a penny more than 35 of your gross annual income. Value of the home you can afford 790800 Monthly payment for mortgage. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the.

Can I borrow more than 5 times my salary. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. As part of an.

Find out how much you could borrow. That means if you. Experts recommend that the monthly cost of the loan should not exceed 30 of the buyers income.

The calculator will ask you to provide all your income streams including your net salary before tax rental income and any other regular sources of income. The first step in buying a house is determining your budget. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of.

How much mortgage can you borrow on your salary. But like any estimate its based on some rounded numbers and rules of thumb. Another guideline to follow is your home should cost no more.

The first step in buying a house is determining your budget. This home affordability calculator provides a simple answer to the question How much house can I afford.

What Is A Foolproof Investment Strategy For The Next 30 Years Quora

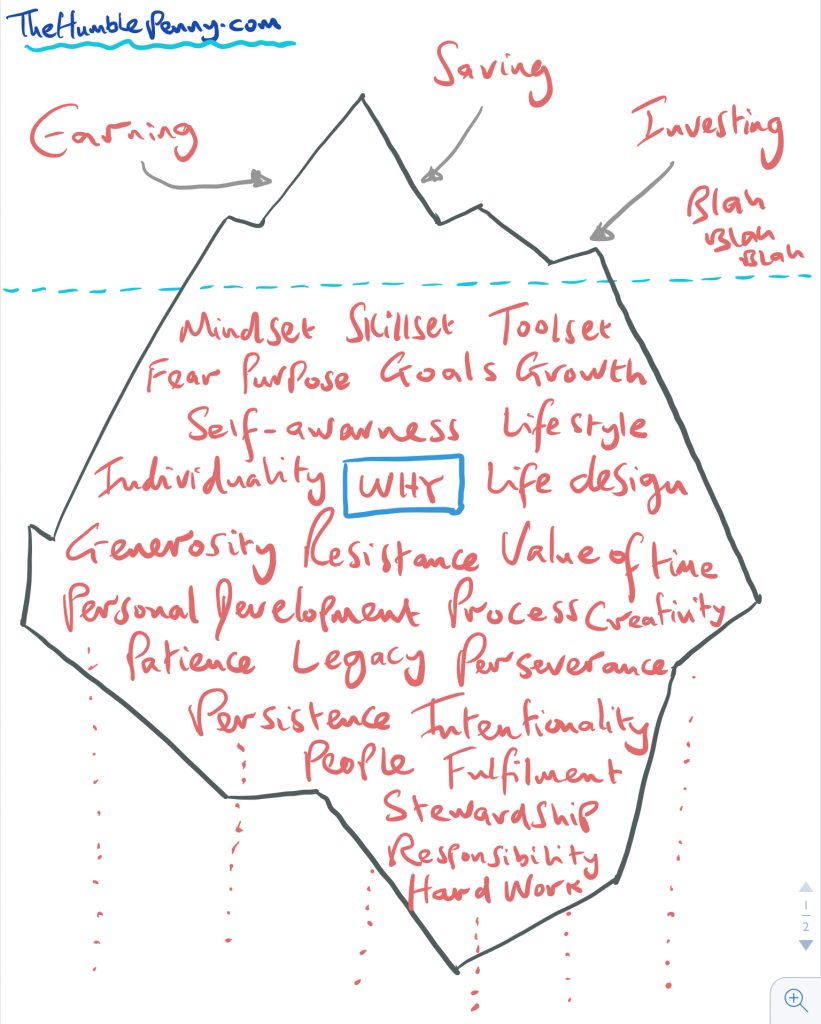

How To Become Financially Independent In Your 30s The Humble Penny

Is It Realistic For A Mortgage Loan Originator To Make Six Figures Quora

30 Clever Ways To Save Money At Christmas Time Saving Money Christmas Time Ways To Save Money

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor

How To Become Financially Independent In Your 30s The Humble Penny

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

How To Become Financially Independent In Your 30s The Humble Penny

Money Synonym 30 Common Forms Of Money In English Eslbuzz Learning English

Transfer Letter Job Transfer Letter Professional Transfer New Job Position Hr Letter Internal Transfer Job Promotion Ms Word In 2022 Job Promotion Lettering New Job

How To Become Financially Independent In Your 30s The Humble Penny

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Moneylion Inc 2021 Annual Report 10 K

30 Diy Disney Crafts For A Disney Vacation Poofy Cheeks Disney Crafts For Kids Disney Crafts For Adults Disney Diy